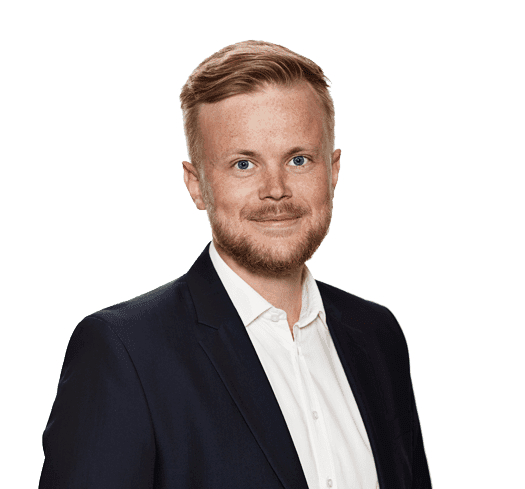

Get an instant overview of your key risk indicators

We are specialized in analyzing complex portfolios across asset classes and managers, and we recognize that complex portfolios may call for a unique reporting solution.

Our reports can be customized to show exactly the key risk indicators that are important to you.

With our Risk Reporting, you get

- A complete overview – of the risk across your entire portfolio, of each asset manager’s portfolio, and of how the risk has developed over time.

- In-depth insight into your risk – we work with a wide range of advanced risk indicators, and we are happy to customize them to meet your specific needs.

- A strong basis for asset-manager comparison – we ensure that the ratio between risk and return is calculated on a unified and comparable basis across your asset managers.

Get a customized risk overview of even the most complex portfolios

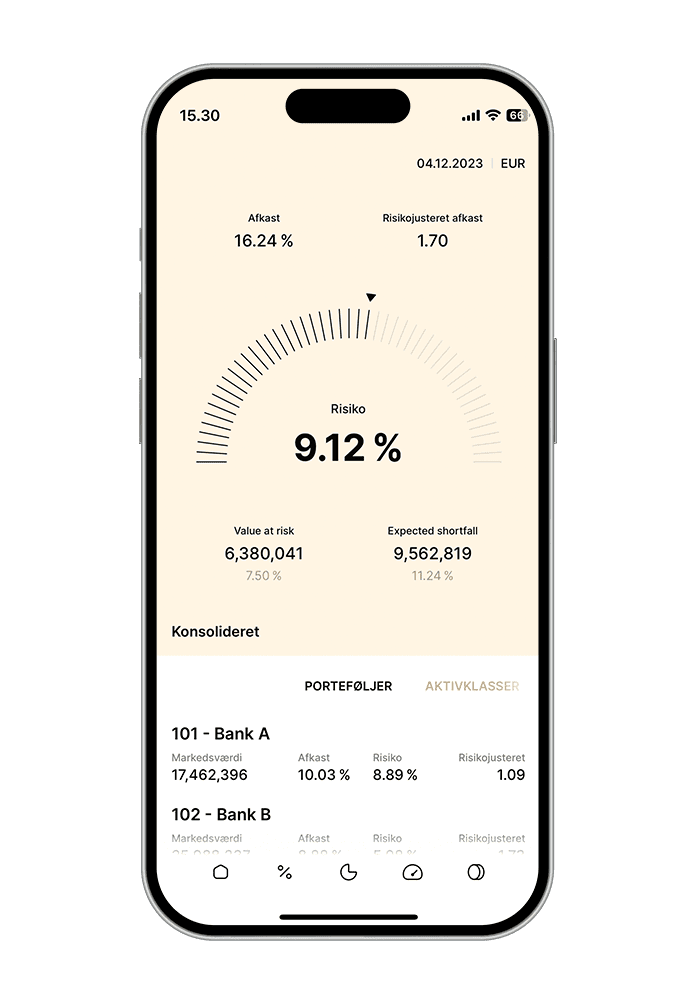

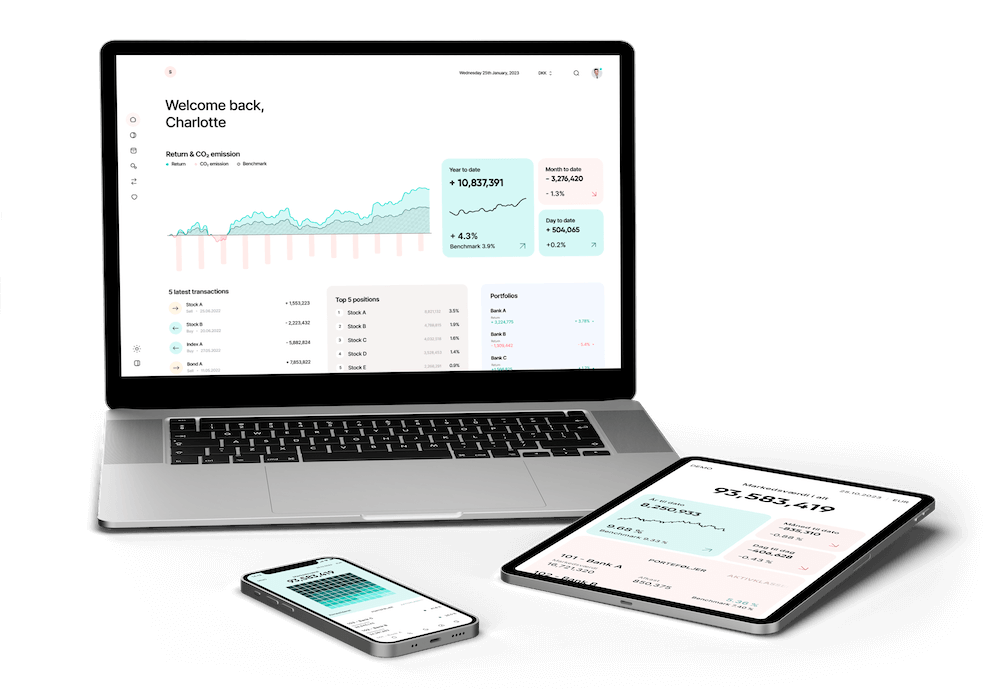

We consolidate your Risk Reporting across asset managers, portfolios, and all asset classes – whether it is liquid investments, Private Equity, real estate, cash, or something else – and give you a complete risk overview in one single platform.

Depending on your preferences, the reporting can both include a quick overview and in-depth insights. With a wide range of advanced risk indicators available, we can customize our solution to ensure that you have easy access to exactly the key risk indicators you need.

We also provide direct data access that enable you to build your own reports with our Business-Intelligence tool. As such, there are virtually no limits as to how much you can go into depth with your investment data.

Make asset-manager comparisons on a consistent data basis

As an independent and objective partner, we ensure that you always have an accurate and comparable overview of the return your asset managers have achieved relative to the degree of risk that was taken to achieve it.

All our calculations are carried out on the basis of objective market data from the biggest suppliers in the world, ensuring a true and fair overview of the performance across your entire portfolio, of each individual portfolio, and of your portfolios in relation to each other.

We automatically integrate data from custodians and manually add data whenever needed, and we take full responsibility for the accuracy of the reported data with an in-house team dedicated to data-quality assurance.

With data you can trust as a strong basis for your financial decisions, our risk reporting empowers you to make more informed decisions about your future investments and choice of asset managers.

Do you want to know more about our risk reporting?