Get a complete and reliable overview of your Private-Equity investments

When investing in Private Equity, it can be difficult to maintain an overview of the total unfunded commitment and the results of the investments.

With Private-Equity Reporting from Hemonto, you always know exactly how much capital the different funds can call from you and what their results have been.

This gives you the overview and insight to make the best decisions for your investments.

What you get with our Private-Equity Reporting

- Peace of mind – we provide you with a reliable overview of how much the different Private-Equity funds can call from you.

- Overview and insight to make the right decisions – we give you an overview of the results of your Private-Equity investments and the possibility to compare the results.

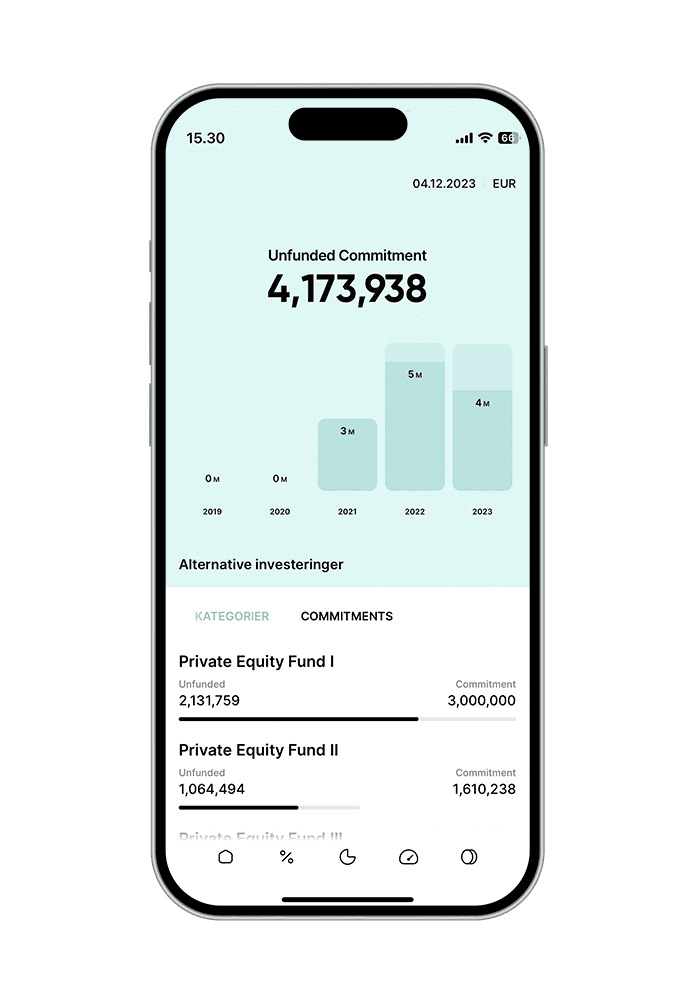

Get a continuous total overview of your unfunded commitments

It is important to always have an overview of your unfunded commitments to the Private-Equity funds you have invested in as they, in principle, can call the rest of your commitment at any time.

In recent years, there has been an almost explosive growth in Private-Equity investments as an alternative to classic investments in securities and real estate, and many investors have invested in several different funds to whom they therefore have commitments.

You should be aware of the following when preparing a statement for your Private-Equity investments

When preparing a statement for Private-Equity investments, there are many things to be aware of – including the following:

- Calls that don’t reduce commitment. It could be management fees and interest expenses.

- Management fees can constitute a relatively large item over the lifetime of a fund. If the fee is not included in the commitment you have made, it can have a large impact on the amount of liquidity you need to have at your disposal.

- Distributions can be recalled and must therefore be added to the unfunded commitment you have to the fund.

As such, it is not an easy task to maintain the overview of all one’s unfunded commitments.

With our reporting, we continuously give you an accurate overview of your unfunded investments across all Private-Equity funds ensuring that you always know exactly how much they can call – individually and totally.

You get an accurate overview of the results of the funds and the possibility of comparing them

There is no common standard among Private-Equity funds in terms of their calculation and reporting of their costs and results. For instance, some funds deduct management fees, interest expenses and other costs in their calculation of returns. In that way, the return will appear higher than it actually is, compared to your total payments to the fund.

As a result, you do not get a true and fair overview of how much you have gained from your investments. The lack of a common standard also means that you, as an investor, unfortunately cannot compare the key figures and returns reported by the different funds.

At Hemonto, we have extensive experience with Private-Equity reporting. We are therefore very acquainted with most Private-Equity funds and their way of reporting. We use this insight to ensure that you get an accurate overview of the return of the funds – for instance, by including management fees and other costs in our calculations.

Since we make use of the same method of return calculation across all funds, we also give you the possibility of comparing the results of the different funds. As a result, you are better equipped to make the best decisions for your investments.

Do you want to know more about our Private-Equity reporting?